Dallas County

Expert guides and tips for property tax protests in Dallas County, Texas.

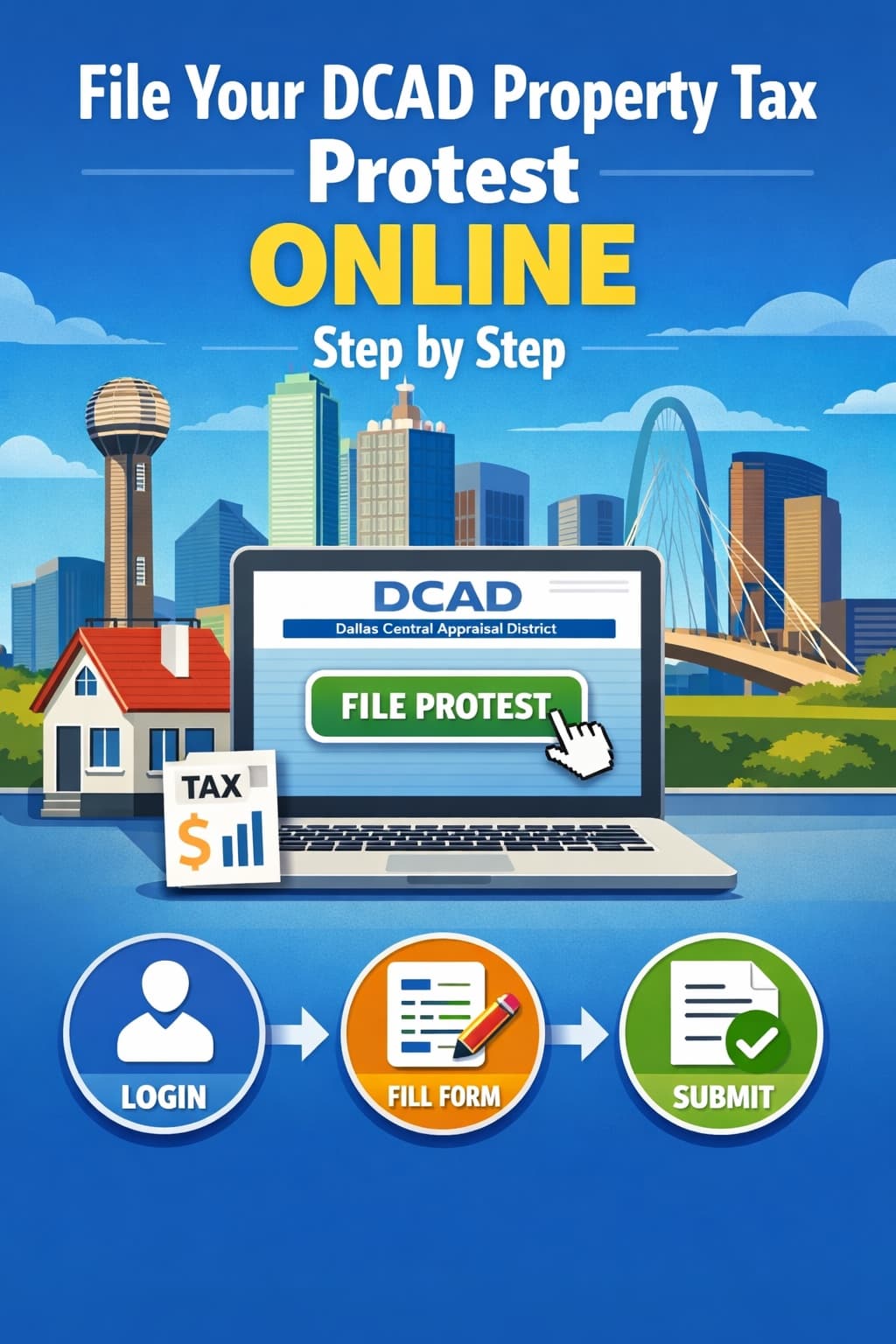

File a DCAD Property Tax Protest Online

Learn how to file a Dallas County property tax protest online using DCAD's uFile system. Step-by-step guide with deadlines, requirements, and tips for success.

January 18, 2026

Read more

Dallas County Property Tax Protest Deadline

Learn the Dallas County property tax protest deadline, filing timeline, and what happens if you miss it. Step-by-step explanation for DCAD homeowners.

December 19, 2025

Read more

Dallas County Property Tax Protest Guide

Protest your Dallas County property taxes before the deadline. Learn how the DCAD protest process works or let experts handle it. No reduction, no fee.

December 13, 2025

Read more

DCAD Residential Property Tax Process Explained

Dallas Central Appraisal District's residential property tax process and how a property tax consultant can help you save on your property taxes.

March 31, 2025

Read more

How To Lower Dallas Property Taxes

Learn how you can pay lower Dallas property tax bills on your home by applying for qualified exemptions and filing a protest.

March 31, 2025

Read more

Dallas Property Tax Protest Process (DCAD)

A guide to navigating the Dallas Central Appraisal District (DCAD) property tax protest process from filing to the Appraisal Review Board hearing.

March 31, 2025

Read more

Dallas Central Appraisal District (DCAD) Guide

Complete guide to the Dallas Central Appraisal District. Learn how to file a property tax protest, apply for exemptions, and contact DCAD at (214) 631-0520.

January 19, 2025

Read moreReady to Lower Your Property Taxes?

Let our expert team handle your property tax protest. No upfront fees - you only pay if we save you money.

GET STARTED