Montgomery County

Expert guides and tips for property tax protests in Montgomery County, Texas.

Montgomery County Property Tax Rate: 2025 Rates by Taxing Entity

Montgomery County property tax rates total approximately 1.91% for Conroe homeowners. See the full breakdown by taxing entity and how to lower your bill.

February 19, 2026

Read more

Montgomery County ARB Hearing Process Explained

What to expect at Montgomery County ARB hearings. Learn how to present evidence and your options after the MCAD decision.

February 14, 2026

Read more

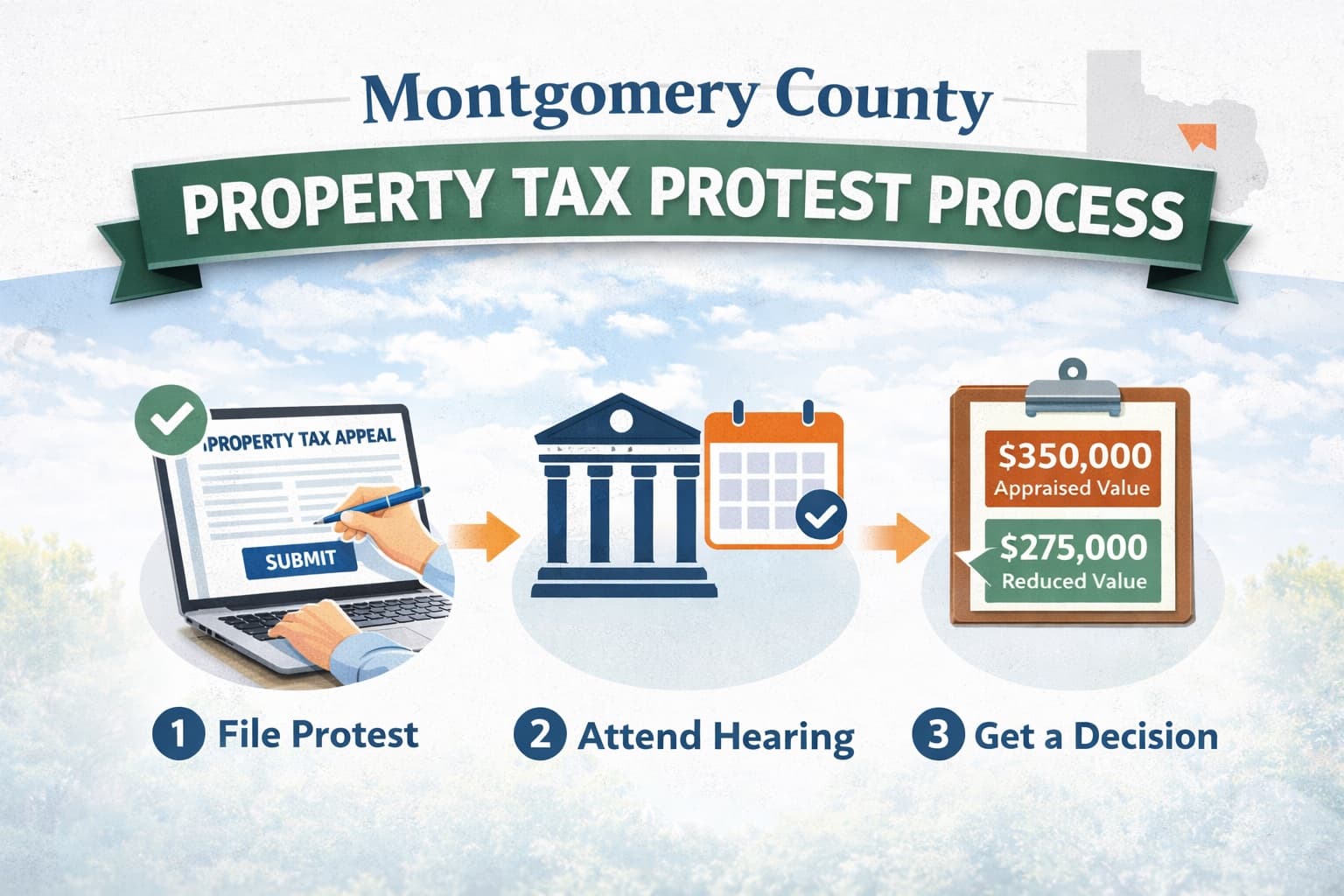

Montgomery County Property Tax Protest Guide

Protest your Montgomery County property taxes before the deadline. Learn how the MCAD protest process works or let experts handle it. No reduction, no fee.

January 13, 2026

Read more

Are Your Montgomery County Property Taxes Too High?

Discover the remedies that are available to reduce Montgomery County property taxes, despite rising home values.

March 31, 2025

Read more

How to Protest Property Taxes in Montgomery County

Step-by-step guide to filing a property tax protest with the Montgomery Central Appraisal District and reducing your Texas tax bill.

March 31, 2025

Read more

Montgomery Central Appraisal District Guide

Understand how the Montgomery Central Appraisal District (MCAD) calculates your property value and how to file a protest to lower your taxes.

March 31, 2025

Read more

Montgomery County Property Tax Protest Deadline

If you're unhappy with your Montgomery County property tax assessment, find out how and when to file a protest.

March 31, 2025

Read moreReady to Lower Your Property Taxes?

Let our expert team handle your property tax protest. No upfront fees - you only pay if we save you money.

GET STARTED