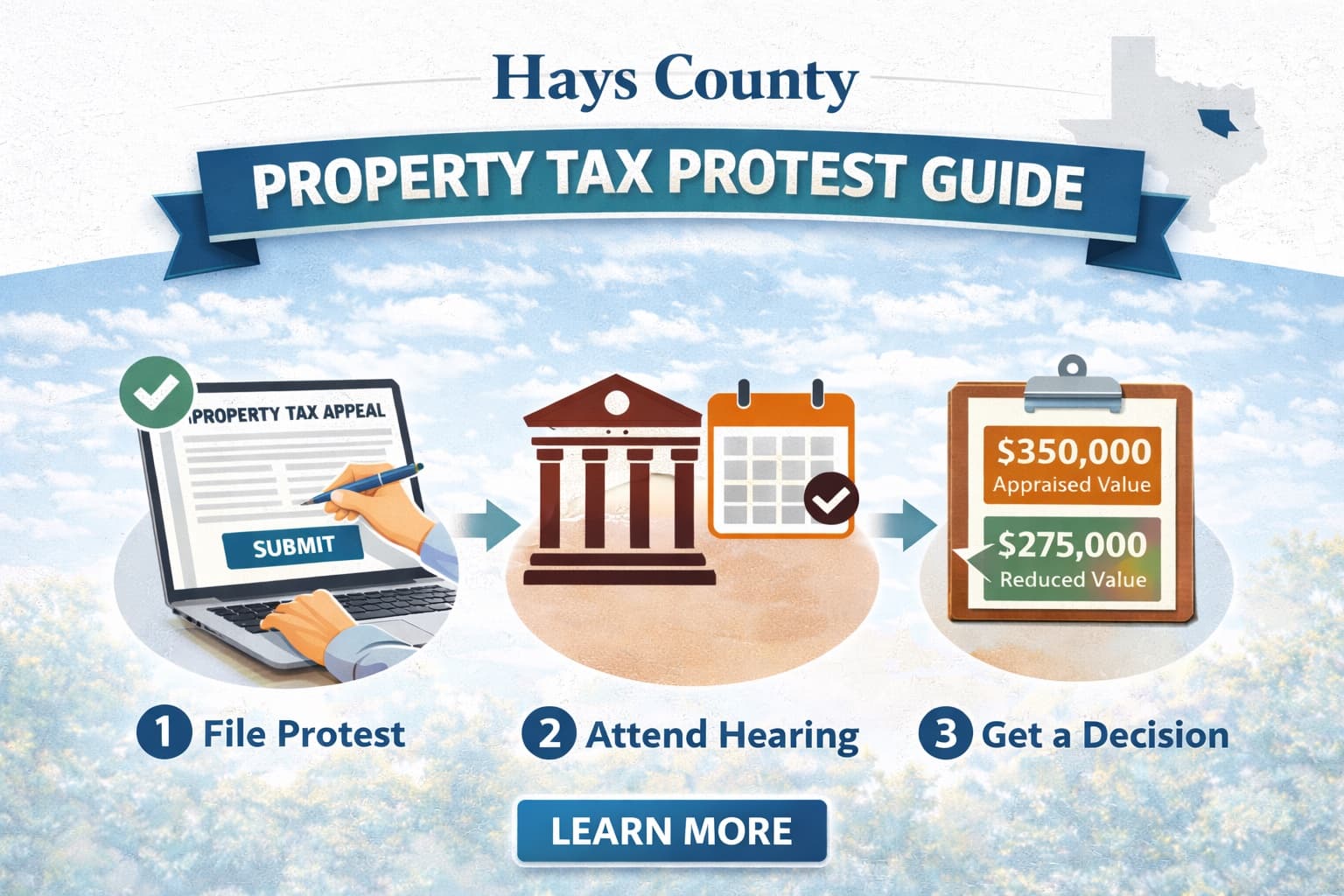

Hays County Property Tax Protest Guide

If you own property in Hays County, Texas, you have the legal right to protest your property's appraised value every year. A properly handled Hays County property tax protest can reduce your taxable value and lower your annual tax bill, but deadlines, evidence, and local procedures matter.

This guide explains:

- The Hays County protest deadline

- How the Hays CAD protest process works

- How to file a protest online

- What evidence actually leads to reductions

- When hiring a property tax consultant makes sense

Hays County Property Tax Protest Deadline

The Hays Central Appraisal District (Hays CAD) follows Texas state law for protest deadlines.

The deadline to file is:

- May 15, or

- 30 days after the Notice of Appraised Value is mailed whichever is later

Late protests are not allowed after the ARB approves the appraisal records for the year, which typically happens in July.

Why filing early matters in Hays County

- Hays County has high protest success rates (78% at ARB, 80% informal)

- Early filing preserves maximum negotiation leverage

- ARB hearings begin in late April

- Online filing is the fastest way to get your protest reviewed

How to File a Property Tax Protest in Hays County

Hays County offers four filing options, but online filing through Hays CAD is strongly recommended.

Option 1: File Online (Recommended)

Most Hays County homeowners file using the Hays CAD online protest system.

What you need:

- Property account number

- Information from your Notice of Appraised Value

- Selected protest reason or reasons

Steps to file online:

- Go to the Hays CAD online protest portal

- Enter your property information

- Select market value, unequal appraisal, or both

- Submit your protest before the deadline

- Save your confirmation for your records

Online Protest Filing is the fastest and most efficient way to submit your Notice of Protest and have it reviewed by a Hays CAD Appraiser informally for a possible resolution without appearing at a hearing.

Official Hays CAD filing and protest procedures: https://hayscad.com/protest/

Other Filing Options

Hays CAD accepts protests through four different methods. All received protests will be scheduled for a formal hearing with the Hays County ARB.

Learn How Property Tax Protests Work in Texas

For a complete explanation of deadlines, evidence standards, and hearings statewide, read our guide here: Texas Property Tax Protest Guide

Official Hays County Appraisal District Resources

For official filing portals, forms, and protest procedures, visit: Hays Central Appraisal District https://hayscad.com

Phone: 512-268-2522 Address: 21001 N. IH 35, Kyle, TX 78640-4795

What to Expect: The Hays CAD Protest Process

While Texas law governs the overall protest framework, Hays CAD procedures and timelines are county-specific.

Filing and Confirmation

Once your protest is submitted, Hays CAD will confirm receipt and schedule your property for a formal hearing with the ARB. High protest volume means processing timelines vary, especially during peak months.

Informal Conference Process

If you requested an Informal Conference on your protest filing, time permitting, a Hays CAD Appraiser will contact you via email. If they are not able to reach out prior to your scheduled hearing, the informal review will be done the day of your scheduled hearing in person before going in to the ARB meeting.

Many Hays County protests are resolved during an informal review, which is a negotiation with Hays CAD appraisal staff before any formal hearing occurs.

Submitting strong evidence early often improves outcomes.

ARB Hearing Process in Hays County

If no agreement is reached informally, your case proceeds to the Hays County Appraisal Review Board (ARB).

ARB hearings:

- Begin in late April each year

- Are conducted at the Hays CAD Appraisal Office at 21001 N IH 35, Kyle, Texas

- Are conducted by independent board members

- Require timely and properly submitted evidence

- Allow both Hays CAD and the property owner or representative to present arguments

Property owners are not required to attend and may appoint a representative to appear on their behalf.

What Evidence Wins Hays County Property Tax Protests

Filing preserves your rights. Evidence determines results.

The most effective evidence includes:

Comparable Sales

- Recent sales near your property

- Similar size, age, and condition

- Adjustments for differences

Unequal Appraisal

- Proof your property is assessed higher than similar properties

- One of the strongest arguments under Texas law

- Especially effective in Hays County due to mass appraisal variance

Property Condition Issues

- Deferred maintenance

- Structural or functional problems

- Photos and repair estimates significantly strengthen claims

Hays County valuations rely heavily on mass appraisal models that often overlook individual property characteristics.

Hays County Property Tax Protest Timeline

| Date | Milestone |

|---|---|

| January 1 | Valuation date (values assessed as of this date) |

| April 15 | Notices of Appraised Value typically mailed |

| Late April | ARB hearings begin |

| May 15 | Protest deadline for most properties |

| May–July | Informal reviews and ARB hearings |

| July | ARB approves appraisal records (late protests no longer accepted) |

| Summer | Final values issued |

Timelines vary based on filing date and protest volume.

Common Hays County Property Tax Protest Mistakes

Avoid these errors that lead to higher tax bills:

- Missing the deadline - No extensions granted after ARB approves records

- Filing without comparable sales - Weakens your case significantly

- Submitting outdated evidence - Must reflect current market

- Not requesting an informal conference - Misses opportunity for early resolution

- Missing Hays CAD evidence deadlines - Limits what you can present

- Accepting the first offer - Always review before agreeing

For a detailed step-by-step walkthrough, see our Hays County property tax protest step-by-step guide.

Why Hire a Hays County Property Tax Consultant?

Professional representation improves outcomes while saving time.

Benefits of professional representation

- Access to strong comparable sales data

- Unequal appraisal analysis

- Experience negotiating with Hays CAD

- Representation at informal reviews and ARB hearings

- No time commitment from you

Ballard Property Tax Protest approach

- No upfront fees

- You only pay if we reduce your value

- Hays County specific strategies

- Annual review and representation

Let Ballard Property Tax Protest handle your Hays County property tax protest. No reduction, no fee.

Frequently Asked Questions About Hays County Property Tax Protests

Can protesting increase my property taxes?

No. Texas law does not allow appraisal districts to raise your value solely because you protested.

Do I need to attend a Hays CAD ARB hearing?

No. You may appoint a representative to attend on your behalf.

Can I protest every year in Hays County?

Yes. Texas law allows annual protests.

How long does the Hays County protest process take?

Most protests resolve within weeks to a few months, depending on volume.

Is Hays CAD online filing secure?

Yes. Hays CAD's online system is secure and preferred.

What are my chances of success?

Hays County has strong protest success rates, with 78% of ARB protests and 80% of informal protests resulting in reductions.

Get Help With Your Hays County Property Tax Protest

If you want to maximize your chances of success without gathering evidence, managing deadlines, or attending hearings, professional representation can make a meaningful difference.

Ballard Property Tax Protest manages the entire Hays County protest process from filing through resolution.

Start your Hays County property tax protest today.