Rockwall County Property Tax Protest Deadlines Explained

Missing the Rockwall County protest deadline can cost you thousands in unnecessary property taxes. Every year, Rockwall County homeowners have a limited window to challenge their appraised value through the Rockwall Central Appraisal District (RCAD).

With median home values in Rockwall County around $420,000 and an effective property tax rate of approximately 1.34%, the stakes are significant. Understanding and meeting the protest deadline is the first critical step to protecting your right to appeal.

This guide explains:

- The Rockwall County property tax protest deadline

- When appraisal notices are mailed

- Key dates in the protest timeline

- How to file online through RCAD

- What happens if you miss the deadline

- Late filing exceptions under Texas law

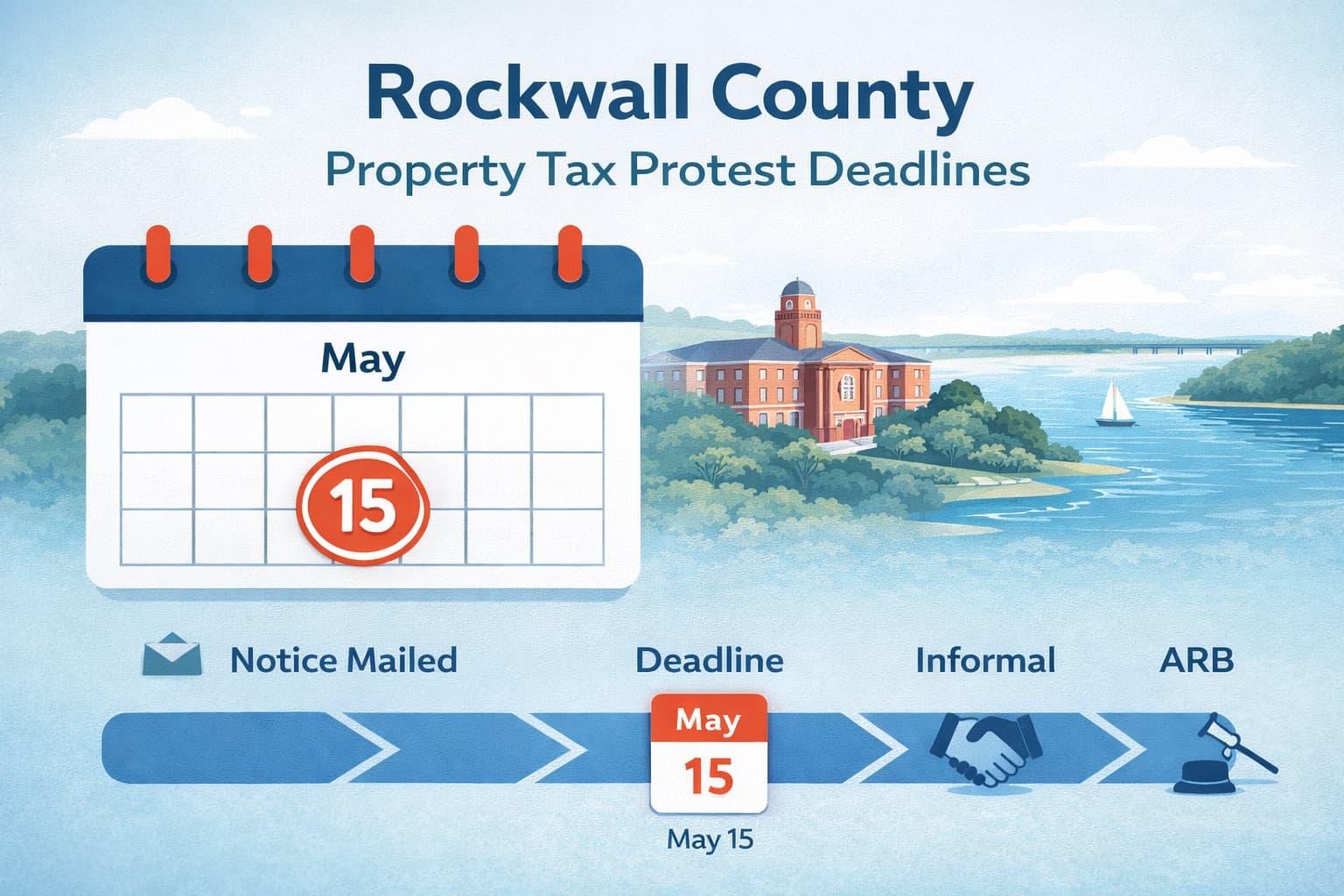

What Is the Rockwall County Property Tax Protest Deadline?

The deadline to file is May 15, 2026, or 30 days after your Notice of Appraised Value is mailed, whichever is later.

This deadline is set by Texas Property Tax Code and strictly enforced by RCAD. Protests must be submitted to the Rockwall Central Appraisal District no later than midnight on May 15.

If the deadline falls on a weekend or holiday, it automatically extends to the next business day.

Filing on time is the single most important step in protecting your right to appeal. Late protests are rarely accepted and require documented "good cause" that meets specific legal standards.

When Does Rockwall County Mail Appraisal Notices?

The Rockwall Central Appraisal District typically mails Notices of Appraised Value in April, with most residential notices arriving by mid-to-late April.

Your notice includes:

- Proposed market value for your property

- Prior year assessed value

- Property identification details

- Instructions for filing a protest

- Information about your filing options

Important: The 30-day clock starts from when RCAD mails the notice, not when you receive it. Even if you don't receive a notice, you are still responsible for knowing the deadline.

Check the RCAD website at rockwallcad.com or contact their office at 972-771-2034 to verify your property's status.

Rockwall County Property Tax Protest Timeline

Below is the typical timeline for residential property tax protests in Rockwall County.

January 1

- Valuation date

- Property value is based on market conditions as of this date

April (Mid-Month)

- Notices of Appraised Value mailed

- Online filing portal available

- Assessment notices typically reach mailboxes by mid-May

April 15 - May 15

- Filing window

- Property owners file protests

- Evidence preparation begins

- RCAD portal activity increases

May 15

- Protest deadline

- Must file by this date (or 30 days after notice, whichever is later)

- Protests must be received by midnight

May - July

- Informal reviews conducted

- Many cases resolved without formal hearing

- Informal property tax protests in Rockwall County are successful 91% of the time

- ARB hearings scheduled if needed

14 Days Before Hearing

- ARB hearing notice mailed

- Includes date, time, and location

- Evidence exchange deadlines apply

Summer

- ARB hearings held

- Final values determined

- ARB hearings are successful 63% of the time

- Decision letters sent

30 Days After ARB Decision

- Appeal deadline to SOAH (State Office of Administrative Hearings)

60 Days After ARB Decision

- Appeal deadline for binding arbitration or district court

October

- Tax statements mailed (typically mid-October)

How to File a Rockwall County Property Tax Protest Online

RCAD offers an electronic filing system for online protest filing, which is faster and more convenient than mail.

To file online:

- Visit rockwallcad.com

- Navigate to the electronic filing or protest section

- Enter your property account number and identification details

- Select your protest reason (market value, unequal appraisal, or both)

- Add comments explaining your reasons for protest

- Submit your protest before the deadline

- Save your confirmation for your records

Filing early provides advantages:

- Higher chance of receiving settlement offers during informal review

- More time for evidence preparation

- Less system congestion

- Better scheduling flexibility for hearings

Alternative filing methods:

You can also file by mail or in person using Form 50-132 (Property Owner's Notice of Protest).

| Method | Details |

|---|---|

| 841 Justin Road, Rockwall, TX 75087-4842 | |

| In Person | Same address during business hours |

| Recommended | Certified mail to confirm receipt |

Cost: There is no fee to file a property tax protest with RCAD. The protest process is designed to be accessible to all property owners.

What Happens If You Miss the Deadline?

If you miss the May 15 deadline:

- Your protest may be dismissed

- You may be locked into the proposed value for the year

- Your tax bill will be based on the unchallenged appraisal

- Your ability to file a standard protest is gone for that tax year

Missing this deadline means your appraised value becomes final and generally cannot be contested unless you qualify for one of the legal exceptions under Texas law.

Not knowing about the deadline is not considered good cause for a late filing.

Late Filing Exceptions Under Texas Law

While the May 15 deadline is strict, Texas Property Tax Code provides several exceptions that may allow late filing in specific circumstances.

Good Cause Exception

The Appraisal Review Board (ARB) can grant a late protest hearing if you can demonstrate good cause for missing the deadline. Examples include:

- Serious illness or medical emergency

- Military deployment

- Death in the family

- Natural disaster affecting your ability to file

You must file before the ARB approves appraisal records (typically mid-July).

Failure to Receive Notice

You may protest failure to receive a notice that RCAD or the ARB was required to send you. You must:

- File this protest before the tax delinquency date

- Not allow your property taxes to become delinquent

Motion for Correction (Section 25.25)

Texas law provides additional remedies for specific situations:

Section 25.25(c) - Major Errors:

- Clerical errors

- Multiple appraisals of a property

- Inclusion of property that does not exist

- January 1 ownership errors

- Available for current year plus five prior years

Section 25.25(d) - Simple Mistakes:

- Math errors

- Wrong square footage

- Data entry mistakes

- Available for the current tax year

Homestead Overvaluation

You may file a motion for correction if your residence homestead property is appraised at least 25% higher than its correct appraised value.

Disaster Damage

If your property suffered damage equal to at least 15% of its market value due to disasters such as tornadoes, freezes, fires, or floods, you can apply for a mid-year value adjustment, even outside the normal protest timeline.

Should You File Early or Wait?

Filing early is strongly recommended in Rockwall County.

Benefits of early filing:

- Access to informal review scheduling flexibility

- More time for evidence preparation

- Better access to settlement negotiations

- Reduced risk of technical issues with RCAD portal

- Less congestion in RCAD systems near deadline

Filing in the final days increases your chances of errors and missed deadlines. RCAD portals can slow significantly as the May 15 deadline approaches due to high volume.

Rockwall County Contact Information

| Resource | Details |

|---|---|

| Phone | 972-771-2034 |

| Address | 841 Justin Road, Rockwall, TX 75087-4842 |

| Website | rockwallcad.com |

| Online Filing | Available through RCAD website |

Rockwall County Protest Success Rates

Rockwall County property owners see strong results when they protest:

| Stage | Success Rate |

|---|---|

| Informal protests | 91% |

| ARB hearings | 63% |

The high success rate at the informal level demonstrates that RCAD is generally willing to negotiate reasonable adjustments when property owners present valid concerns. Filing early and preparing strong evidence significantly improves your chances.

Evidence That Strengthens Your Protest

While meeting the deadline preserves your right to protest, evidence determines results. Start gathering documentation before or immediately after you file.

Comparable Sales

- Recent sales of similar properties near yours

- Same neighborhood, similar size, age, and condition

- Adjustments for differences in features

Unequal Appraisal Evidence

- Proof your property is assessed higher than comparable properties

- One of the strongest arguments under Texas law

- Particularly effective in Rockwall County's growing market

Property Condition Documentation

- Photos showing current condition

- Repair estimates from contractors

- Documentation of deferred maintenance or defects

Market Analysis

- Professional appraisals

- Recent market data

- Documentation of any factors affecting value

Frequently Asked Questions

What is the Rockwall County property tax protest deadline for 2026?

The deadline is May 15, 2026, or 30 days after your Notice of Appraised Value is mailed, whichever is later. This deadline is strictly enforced by RCAD.

How do I file a Rockwall County property tax protest online?

Visit rockwallcad.com, navigate to the electronic filing section, enter your property information, select your protest reason, and submit. You can also file by mail or in person at 841 Justin Road, Rockwall, TX.

What happens if I miss the Rockwall County protest deadline?

Your protest will likely be dismissed, and you'll be locked into the proposed value for the year. Late protests require proof of "good cause" (serious illness, military deployment, etc.) and must be filed before the ARB approves records (typically mid-July).

Can I protest my Rockwall County property taxes if I didn't receive a notice?

Yes. Not receiving a notice doesn't waive your right to protest, but you're still responsible for meeting the deadline. Check the RCAD website or call 972-771-2034 to verify your property's assessed value and deadline.

Is there a fee to file a property tax protest in Rockwall County?

No. Filing a protest with RCAD is free. The protest process is designed to be accessible to all property owners seeking a fair assessment.

How long do Rockwall County property tax protests take?

Most protests resolve within weeks to a few months. Informal reviews happen May through July, with ARB hearings scheduled through summer. Filing early gives you more scheduling flexibility.

What is the success rate for Rockwall County property tax protests?

Informal protests in Rockwall County are successful 91% of the time, while ARB hearings have a 63% success rate. Strong evidence and early filing improve your chances.

How This Fits Into the Texas Protest Process

Rockwall County follows Texas Property Tax Code procedures, but RCAD has specific systems and timelines.

For statewide context on deadlines, evidence strategies, and hearing procedures, see our Texas property tax protest guide.

Get Help With Your Rockwall County Property Tax Protest

Understanding deadlines is the first step. Winning your protest requires strong evidence, proper filing, and negotiation strategy.

If you want help managing deadlines, preparing evidence, and handling RCAD negotiations, professional representation can simplify the process and improve your results.

Visit our Rockwall County page or get started today with Ballard Property Tax Protest.