Travis County

Expert guides and tips for property tax protests in Travis County, Texas.

Austin Property Tax Rate: 2026 Rates by Taxing Entity

Austin property tax rates total approximately 2.07%. See the full breakdown by taxing entity and how to lower your bill.

February 17, 2026

Read more

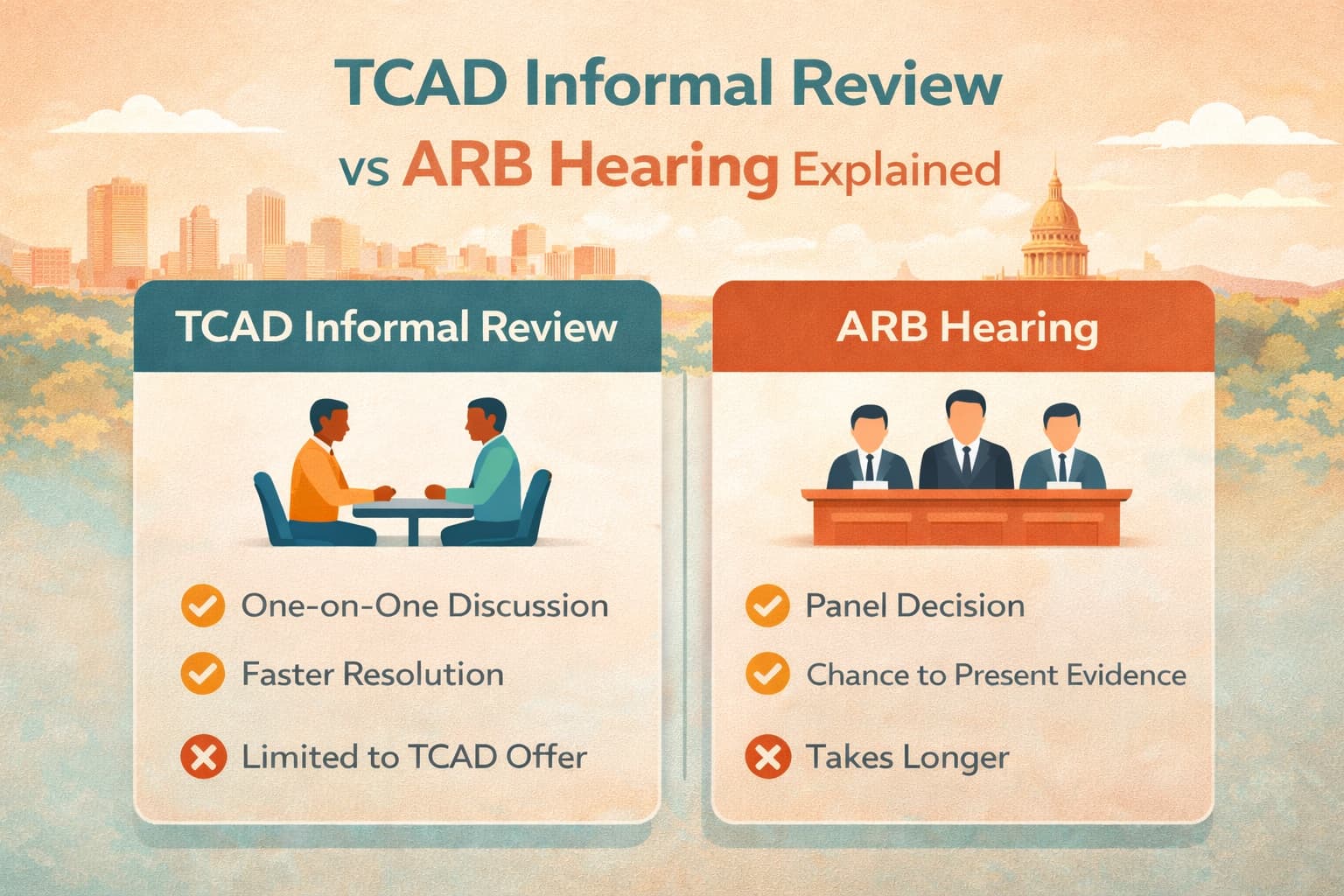

TCAD Informal Review vs ARB Hearing Explained

Understand the difference between TCAD informal reviews and ARB hearings. Learn when to use each approach for your Travis County property tax protest.

February 13, 2026

Read more

Travis County Property Tax Protest Deadlines

Don't miss the Travis County property tax protest deadline. Complete guide to TCAD filing dates, late protest options, and what happens if you miss May 15.

January 8, 2026

Read more

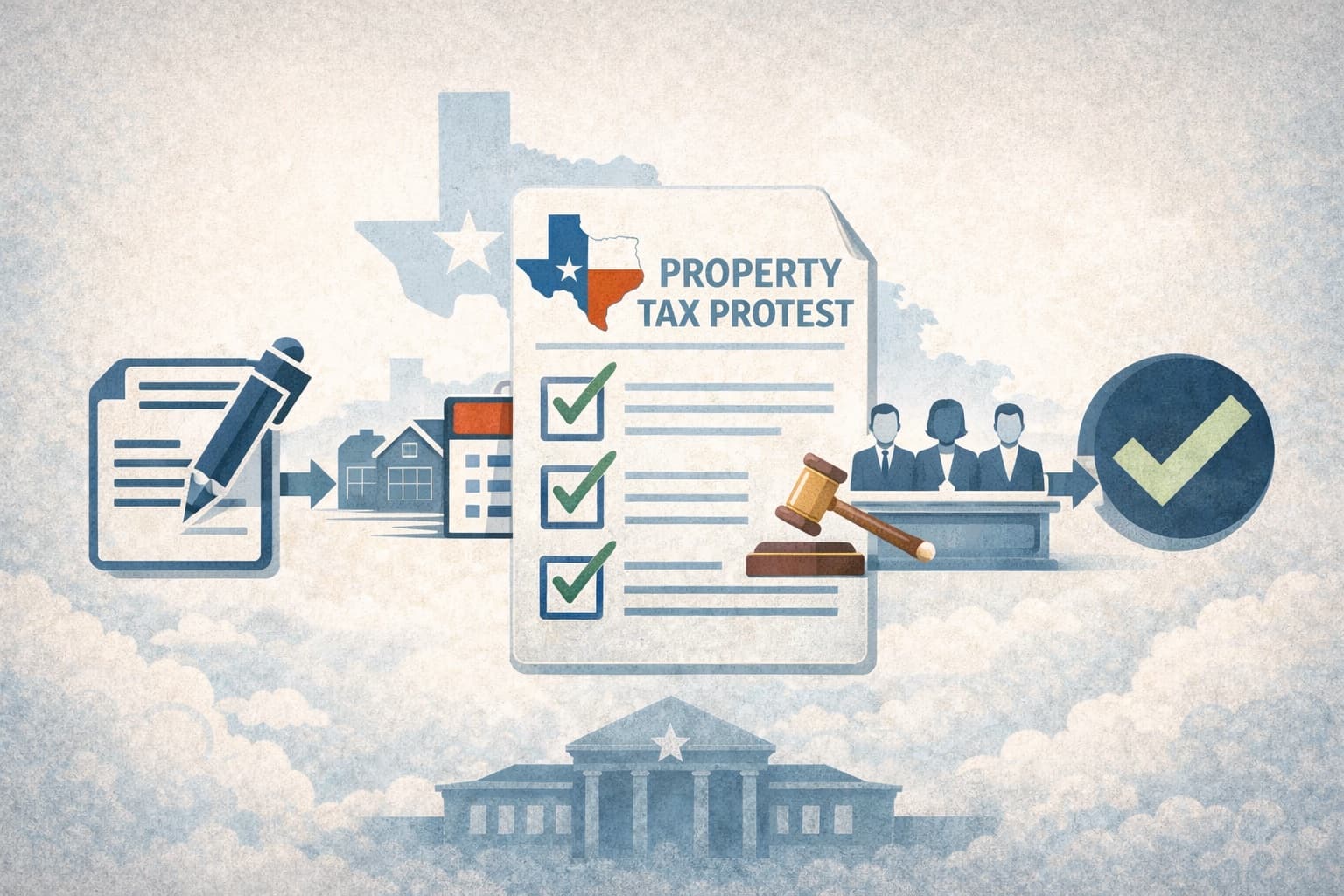

Travis County Property Tax Protest Guide

Protest your Travis County property taxes before the deadline. Learn how the TCAD protest process works or let experts handle it. No reduction, no fee.

January 4, 2026

Read more

Travis County Homestead Exemptions Guide

Discover everything you need to know about applying for and receiving homestead exemptions to save money on your Travis County property taxes.

March 31, 2025

Read more

Travis County Property Tax Protest: File 2026

File your Travis County property tax protest by May 15, 2026. Step-by-step guide to protesting with TCAD, plus deadlines, evidence tips, and ARB hearing info.

January 19, 2025

Read moreReady to Lower Your Property Taxes?

Let our expert team handle your property tax protest. No upfront fees - you only pay if we save you money.

GET STARTED