General Info

Articles and resources about general info for Texas homeowners.

When Do Texas Property Tax Bills Come Out? (2026 Calendar)

Texas property tax bills are mailed in October. See the complete 2026 property tax calendar with key dates for notices, protests, bills, and payment deadlines.

January 30, 2026

Read more

Texas Property Tax Protest Success Rates 2026

See Texas property tax protest success rates by county. Learn how often protests succeed, average savings, and what affects your chances of winning.

January 25, 2026

Read more

Areas for Improvement for Texas Property Taxes

The Texas property tax system is in need of reform, especially as it relates to the appraisal process. Learn More.

March 31, 2025

Read more

Benefits of Filing a Texas Property Tax Protest

Discover how a successful Texas property tax protest can cut your tax bills not only this year, but potentially for every year you own your home.

March 31, 2025

Read more

Home Renovations and Texas Property Taxes

Find out whether that new addition or pool will increase your Texas property tax bills in this guide to home renovations and tax liability.

March 31, 2025

Read more

How Texas CAMA Property Tax Appraisals Work

Discover how Computer Assisted Mass Appraisal techniques could wrongly calculate your home's Texas property taxes

March 31, 2025

Read more

Property Tax Protests and Home Resale Value

Find out how securing a lower tax assessed value during a Texas property tax protest can boost your home's resale price.

March 31, 2025

Read more

Property Tax Rules in the Texas Constitution

Find out what the Texas Constitution has to say about your home's property taxes, including changes from two recently approved amendments.

March 31, 2025

Read more

Should You Protest Texas Property Taxes Yearly?

Yes, Texas homeowners can protest property taxes every year. Learn why annual protests are recommended and how they protect your tax savings long-term.

March 31, 2025

Read more

Texas Property Tax Law Changes: 2023-2026

Texas property tax law changes from Prop 4 (2023) to the 89th Legislature (2025). Homestead exemptions, rates, and 2026 updates.

March 31, 2025

Read more

Texas Property Tax Protest Deadlines

Missed the Texas property tax protest deadline? Learn your remaining options including late protests for clerical errors and substantial overvaluations.

March 31, 2025

Read more

Texas Property Tax Protests After the Deadline

Determine all your options for securing lower bills for this year even if you already missed your local Texas property tax protest deadline.

March 31, 2025

Read more

Texas Property Tax Protest Deadlines for 2026

Key deadlines for 2026 Texas property tax protests. File by May 15, 2026 or 30 days after your notice—whichever is later.

March 31, 2025

Read more

Texas Senate Bill Proposal: Impact on Property Taxes

Learn how Texas Senate Bill 4 proposes increasing the homestead exemption to $140,000, potentially saving homeowners hundreds annually on property taxes.

March 31, 2025

Read more

Where Do Texas Property Taxes Go?

Learn what your Texas property taxes fund, from schools to roads, and discover how to protest if you believe your tax bill is too high.

March 31, 2025

Read more

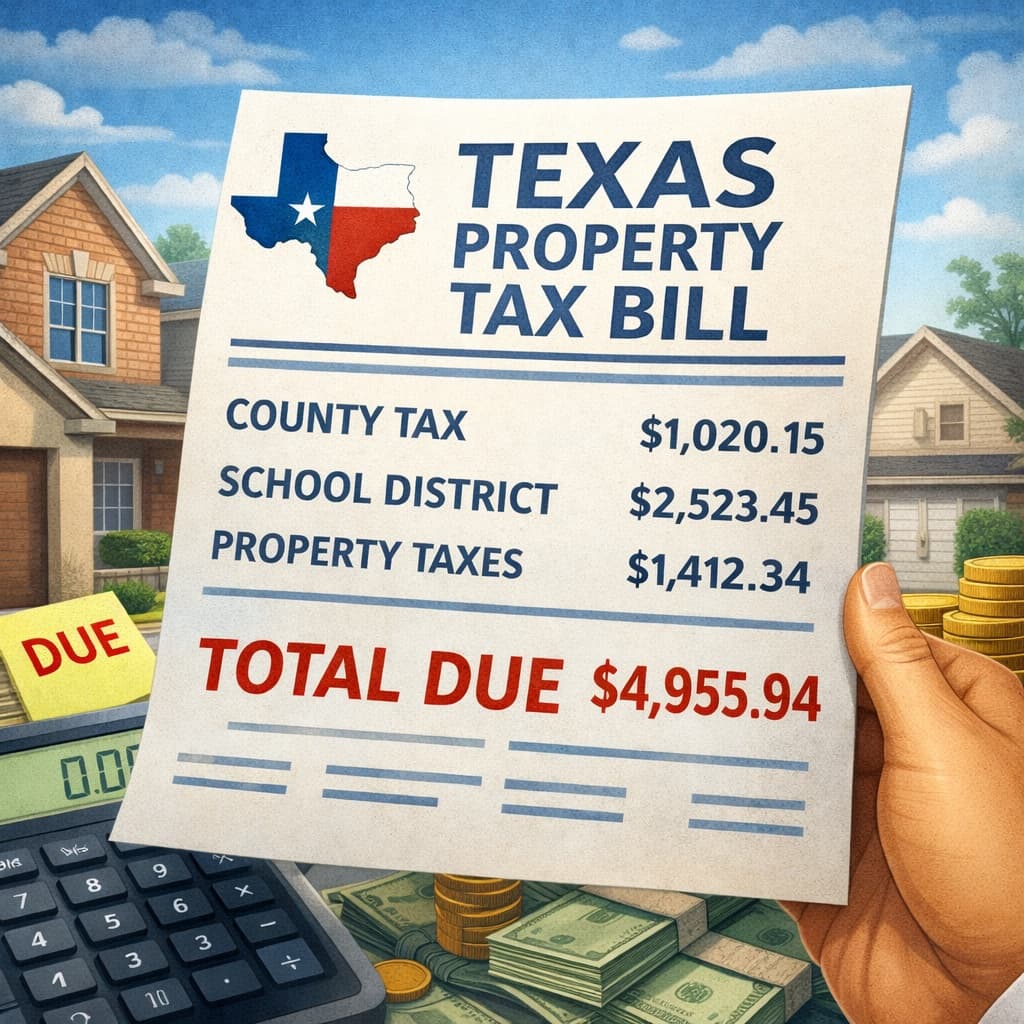

What Your Texas Property Tax Bill Really Means

Your annual Texas property tax evaluation provides detailed information about your home. Learn how to read it here.

March 31, 2025

Read more

Texas Tax Assessor Home Visits: Your Rights

You're not required to let a Texas tax assessor inside your home. But should you? Learn when it could lower your taxes.

January 19, 2025

Read more

Texas Property Tax Exemptions for Seniors 65+

Texas seniors 65+ qualify for $200,000 in exemptions plus a tax freeze. Learn how to claim your over-65 exemption.

January 19, 2025

Read moreReady to Lower Your Property Taxes?

Let our expert team handle your property tax protest. No upfront fees - you only pay if we save you money.

GET STARTED